During the course of buying the farm an interesting question came up about “buying points”. This was our first mortgage so I was pretty curious about everything going on with the banks and inspectors and such. Our lender casually mentioned the option of buying points and then quickly dismissed it as something that no one ever does. In fact, she had only seen it done once. When she said that I got even more interested.

I know not all beginning (or existing) farmers will be able to buy land, but for those who do I thought this topic would be helpful. There's not much good info about the trade-offs between buying points and putting down a larger down payment online, so this is just my own analysis, I'm very welcome to other opinions.

What’s “buying points”?

Points May Make More Sense Than Higher Down Payment

The loan officer also tells you that you could buy points and that it would lower your interest rate by 0.25% for each point. At most you could buy 2 points and your interest rate would go from from 5% to 4.5%. He says that each point costs $2,500 (this amount will vary depending on the bank and current rates at the time). So for an incremental $5,000 (for two points) you could pay a 4.5% rate.

You already know that for an additional 5% down ($15,000) you would save $30,000 over the next 30 years. The question is what would buying points save you over the life of the loan?

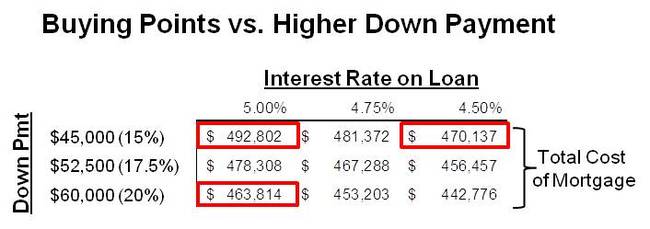

Here’s a table showing the various outcomes based on different down payments and different interest rates. The numbers in the middle of the table are the total cost of the mortgage over the life of the loan. Included in the 4.75% and 4.5% columns are the incremental $2,500 and $5,000 cash costs for buying the associated points.

As you can see, the cost of a $300,000 mortgage with 20% down and a 5% interest rate will be $463,814 over 30 years. The same mortgage with 15% down would cost $492,802 in total. The additional $15,000 you put down at the beginning would save $29,000 over 30 years.

If you buy two points for $5,000 and put 15% down you’ll end up paying $470,137 over the life of the loan. Compared to not buying points you are saving close to $23,000.

So in these two situations you can either put $15,000 down and save $29,000 or put $5,000 down and save $23,000. Which would you rather do? Putting more down on the home will earn you a return of 5% per year (your interest rate). Meanwhile, buying points and staying in the home for 30 years will earn you closer to a whopping 15% per year. Try to beat that in the stock market (actually don't, just buy the points).

Taken one step further you could take the $10,000 difference and apply it to the principal right away and save even MORE money over the life of the loan.

Drawback of Buying Points

How do you think about that? Basically, you just need to figure out how many years of your lower monthly payment will equate to the cost of buying points. In my example buying points would save you about $80 per month, or about $950 per year. At an initial cost of $5,000 you will earn back the cost of your points in a little over 5 years.

This means that if you think you’ll be in your home for at least 5 years then you should buy the points. If you’re planning on flipping the home or there’s a high probability that you’ll move then don’t buy the points. Let’s take a case where you don’t think you’ll move before 5 years, but after 3 years you end up moving. It’s not the end of the world. You made back close to $3,000 ($950 x 3) and it cost you $5,000, so you lost $2,000. When compared to the opportunity to save close to $23,000 in the long term it’s not that big of a loss.

Why Do Banks Offer Points?

For the nit-picking financial wizards out there I do realize that in none of these analyses have I taken into account the time-value of money, which should put a value on deploying capital upfront. Given the low interest rates, highly volatile markets and increasing risk of inflation I don’t have a lot of faith in assuming a fair rate of return on my cash.