We were watching the movie Colony last weekend (highly recommended) and I was inspired to follow-up on a topic that I think confuses the heck out of most people. Cash vs. Accrual Accounting. Don’t be alarmed by the word “accrual”, you don’t even need to know what it means to understand the concept. Press on!

Colony is about beekeepers. Not just any beekeepers, these are hardcore beekeepers. They perform a task that I never knew existed. These individuals literally manage and care for thousands of bee hives and transport them all over the country on giant flat-bed trucks to pollinate various crops (almonds, blueberries, etc.). I could write a whole post about how cool that is and how that’s just one more critical component of the food supply chain that most people will never know about, but I’ll save it for another day.

However, as the mother in the film says, the business is consuming $20,000 in cash per year just to keep it running. Well, that may sound like a lot, but there’s no discussion about whether the business is actually unprofitable (e.g. Sales cannot cover the Business' Operating Expenses) or whether the business is just growing so fast that it needs the $20,000 to finance the growth. I think it’s an important topic because I frequently hear comments about “making money” and “being in the black”, but there’s no clarification about whether its on a cash or accrual basis and it’s an important distinction! Here’s where cash vs. accrual accounting comes into play.

Cash accounting is the simplest way to view a business, but can often lead to some confusion about the actual profitability of a business. I suspect this is how the Seppi’s were viewing the family’s beekeeping business (although I really have no idea and am just using this example for illustrative purposes).

An Example

Cash Accounting

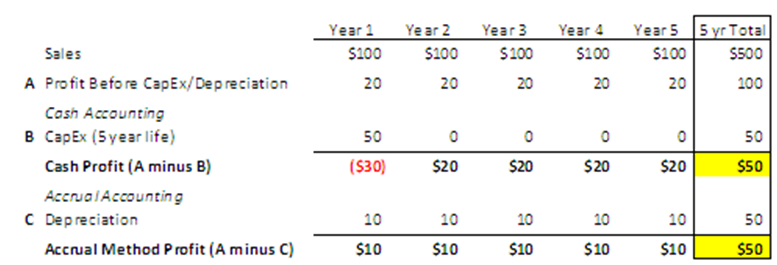

The first major bucket of cash expenses that can make a farm appear unprofitable during a rapid growth period is called Capital Expenditures (CapEx). CapEx is a USE of cash that is associated with buying property, plant or equipment (PP&E). When you buy that new tractor for $30,000 you would be subtracting that from your annual earnings on a cash basis and that could make your farm look far less profitable! The same idea goes for any long-lived assets that you are buying. In the first few years of starting up CapEx can have a huge impact on your cash profitability.

The second major bucket is called “Working Capital”. The components of Working Capital are Current Assets and Current Liabilities. The big three to keep an eye on are Accounts Receivable (Asset), Inventory (Asset) and Accounts Payable (Liability). The concept is pretty simple, an increase in an Asset account is a USE of cash. An increase in a Liability account is a SOURCE of cash. Accounts Receivable are when someone owes you money for product you’ve sold them. The faster you grow the bigger your Accounts Receivable balance will be and as the Asset side of the equation increases it is a USE of cash. You want to keep your Accounts Receivable terms as low as possible! Same goes for Inventory. As your business grows so does the Inventory you are holding. Inventory is a USE of cash. Accounts Payable, on the other hand, may actually be a SOURCE of cash if you can extend your terms with the people that you owe money. The longer your Accounts Payable terms are the better it is from a cash flow perspective. Ideally your Payables will be longer dated than your Receivables and you can operate with a minimal amount of Inventory. That’s why a CSA works so beautifully from a cash/reinvestment perspective. The farm gets the cash upfront (no receivables) and can fund growth each year with that capital.

When you invest in new bee hives and new farm equipment, for instance, that may be cash out the door and you might not see a penny of benefit from those uses of cash for a number of months. But is that a business that’s losing money? Not really. On a cash basis yes, but on an accrual basis it is probably doing just fine. So what’s all this accrual accounting business about?

Accrual Accounting

That’s the problem with growth: where do you find the money to finance the growth and when do you stop reinvesting in the business and harvest the cash flow? That’s a personal decision for many farms and hopefully many farms are lucky enough to have that dilemma! One thing is for certain, you better know what’s happening to your cash and how much you’re reinvesting in the business because when it comes time to pay the bills the bank won’t care if you have a ton of customers with huge Accounts Receivables balances, they want their cash! Plan accordingly and always keep a cash cushion.

If you run a business, how do you think about cash flow and profitability? Can you think of instances where a business may be losing money from a cash perspective but profitable from an accrual perspective?

Accrual Income Determination

Sales

Less: Direct Costs

= Gross Profit

Less: Operating Costs

=Earnings Before Interest, Tax and Depreciation

Less: Interest, Tax and Depreciation

=Net Income (This is your income on an accrual basis)

Cash Income Determination

Net Income (from above)

Less: Change in Accounts Receivable

Less: Change in Inventory

Plus: Change in Accounts Payable

Less: Capital Expenditures

= Free Cash Flow (This is your income on a cash basis)